Week 2: Fuzzy's Taco Shop & Row House

Baja-style Mexican food concept + a boutique fitness brand

Welcome to Franchise Breakdowns, a weekly email covering up & coming franchises to help you find the next big brand. If you’re reading this but haven’t subscribed, you can do so here:

To franchise owners,

Today’s edition highlights Fuzzy’s Taco Shop, a baja style Mexican restaurant, and Row House, a boutique fitness concept.

Fuzzy’s Taco Shop was founded in Dallas, Texas in 2003, and started franchising in 2009. The restaurant has a welcoming vibe, a pet friendly atmosphere, and a drink menu that will make your memory fuzzier than the restaurant!

Row House was founded in New York City in 2014, and is built around the idea that rowing is an efficient, low-impact, high-energy, full-body workout for any fitness level. After starting franchising in 2017, the brand was acquired in 2018 by Xponential Fitness, the monster holding company of other fitness franchises like Club Pilates, YogaSix, CycleBar, and more.

The breakdowns are below 👇

DISCLAIMER: DO NOT CONSIDER ANYTHING WRITTEN BELOW AS INVESTMENT ADVICE. IF YOU DECIDE TO PURCHASE A FRANCHISE, YOU MUST DO YOUR OWN RESEARCH, AND REALIZE ANY INVESTMENT MAY GO TO $0.00.

Fuzzy’s Taco Shop

Background

29.5k Instagram followers

Founded in 2003, franchising since 2009

Serves tacos, burritos, nachos, quesadillas, grilled sandwiches, salads and breakfast dishes

Number of Units

140 locations as of 2020, +12.9% growth from 2017-2020

Source: Entrepreneur.com

Fees, Expenses (2020 FDD)

Initial franchise fee: $35,000

Brand Development Fund: 2% of gross sales

Royalty Fee: 3.5% of gross sales in year one, 5% all subsequent years

Initial Investment (2020 FDD)

Traditional Location: $770,500 - $1,116,500

Non-Traditional Location (Taqueria): $352,500 - $730,000

Note: a traditional location occupies 3,000 - 4,000 square feet, while the Taqueria model occupies 1,000 - 1,500 square feet.

Financial Performance (2020 FDD)

2019 Fiscal Year Performance (all system reporting units are Traditional restaurants):

Of the above reporting units, 124 were franchised restaurants, and 10 were company owned

2019 Fiscal Year, Company-Owned Locations Operational Costs:

The Wolf’s Take 🍟

Unfortunately, the Franchise Disclosure Document doesn’t provide EBITDA, but the highlights are median franchisee revenue of $1,350,555, and prime costs (labor + COGS) of company owned locations landing at 59.8% of revenue.

Adding prime and occupancy costs, then including your royalty (5% fully ramped), brand fund (2%), and miscellaneous expenses, it’s not crazy to think franchisees are taking home 16%-20% of their revenue, assuming their labor and COGS are similar to the franchisor owned locations.

16%-20% income from $1,350,555 in revenue isn’t a bad potential return. Keep in mind that a serious potential buyer of this brand would be given the contact info for existing franchisees, meaning you’d be able to get a good sense directly from a current owner on just how profitable their locations are.

Recent Press

Twitter Watch 👀

On Friday’s I tweet out the financials of a widely known franchise. The most recent one was Auntie Anne’s:

If you’d like to see these tweets in real time, feel free to give me a follow!

https://twitter.com/franchisewolf

Row House

Background

Rowing workouts are completed in 45 minutes

Founded in 2014 in New York City, started franchising in 2017

Acquired in 2018 by boutique fitness holding company, Xponential Fitness

Number of Units

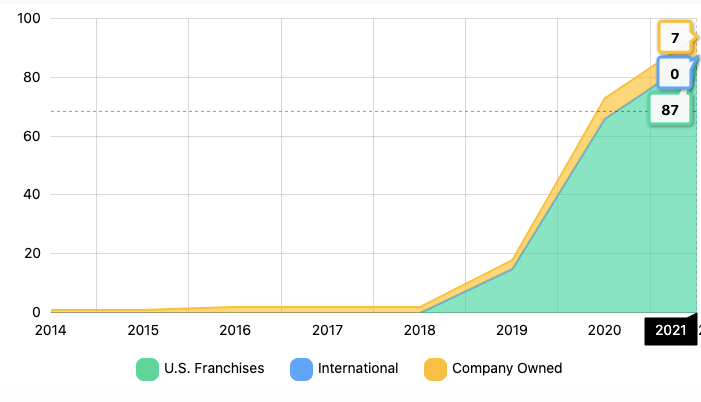

94 units as of 2021

Source: Entrepreneur.com

Fees, Expenses (2020 FDD)

Franchise Fee: $60,000

Royalty: 7% of gross sales

Brand Development Fund: 2% of gross sales

Initial Investment (2020 FDD)

$276,600 - $499,500

Leasehold improvements make up $35,000 - $158,000 of this range

Financial Performance (2020 FDD)

Performance of one franchised location, open the full year 2019:

The Wolf’s Take 🍟

The chart above is the only hard data provided by Row House in the financials. Although they had 51 franchised studios that operated in 2019, the reporting studio was the only location open the full year.

Remember, the FDD doesn’t always tell the full picture. Sometimes a brand has stronger financials than represented, and plenty of times franchises will omit information because they know their numbers just aren’t that compelling. When it comes to Row House, I’d guess it’s the former and not the latter. Why?

They’ve had explosive franchise growth even through covid, and let’s remember who acquired them: Xponential Fitness. Xponential has an extremely impressive portfolio of brands, and they wouldn’t put up the capital for a brand so young if they didn’t see large growth potential.

If you’re interested in operating a fitness concept, this is a brand worth exploring.

Recent Press

That’s it for this week’s Franchise Breakdowns. Feel free to reply with any questions or feedback, or leave a comment. If someone sent this your way and you haven’t subscribed yet, you can also do that below. Thanks and see you next week!

NOTICE REGARDING FRANCHISE INFORMATION

The Wolf of Franchises does NOT guarantee the financial performance of any franchise mentioned. The decision to purchase a licensed affiliate or franchise must be based on your own independent research. The Wolf of Franchises is not liable for any representation made by an affiliate, associate, marketing material, or Franchise Disclosure Document of a franchise with respect to real estate, financial, operations, or marketing performance of the business being acquired.

This information is not intended as an offer to sell, or the solicitation of an offer to buy, a franchise. It is for informational purposes only, and any financial data and/or projections is clearly based upon information provided by franchises in their respective Franchise Disclosure Document. The offer of a franchise can only be made through the delivery of a franchise disclosure document, from a certified seller of the brand, which The Wolf of Franchises makes no claim to be. Do not consider any information here as a guarantee of financial performance. The Wolf of Franchises has no affiliation or relationship of any kind with any of the brands covered in this newsletter, but simply provides data that is publicly available online or in Franchise Disclosure Documents.

All data from Franchise Disclosure Document’s is based on past performance, and if you were to purchase a franchise covered in the Wolf of Franchises newsletter, it is entirely possible that you lose your entire investment and go bankrupt.