Welcome to Franchise Breakdowns, where I cover two up and coming franchises to help you find the next big brand. If you’re reading this but haven’t subscribed, you can do so here:

To franchise owners,

Today I’ve broken down two very popular franchises, KFC and The UPS Store.

When I officially launch the newsletter in a few weeks, it typically won’t cover such large brands that have reached scale, but will be more focused on small to medium sized franchises.

The goal is to provide analysis on brands that show a lot of potential, but are still small enough that there is available territory for you should you pursue one of the brands.

Here is what you can expect from the weekly email:

Analysis of 1 restaurant brand and 1 non-restaurant brand

Brand will be small - medium sized franchises (2 - 200 locations nationwide)

The newsletter will ALWAYS be FREE

See below for what the format of each brand breakdown will be.

DISCLAIMER: DO NOT CONSIDER ANYTHING WRITTEN BELOW AS INVESTMENT ADVICE. IF YOU DECIDE TO PURCHASE A FRANCHISE, YOU MUST DO YOUR OWN RESEARCH, AND REALIZE ANY INVESTMENT MAY GO TO $0.00.

KFC

Background

Founded in 1930, started franchising in 1952

Headquartered in Louisville, Kentucky

Franchisor is owned by Yum! Brands, the owners of other brands such as Pizza Hut and Taco Bell

Fees, Expenses

Royalty: 4-5% of gross revenue OR monthly payment of $1,260 whichever is greater

National Co-Op Fee: 4.5% of gross revenue

Franchise Fee: $45,000

Initial Investment

Newly constructed outlets: $1.4M - $2.7M

Remodel an existing outlet: $1M - $2.2M

Financial Performance

Average net sales of company owned units (44 units): $1,296,962

Average net sales of franchisee owned units (2,982 units): $1,193,701

Average cost of labor for company owned units was $399,192

Average cost of product for company owned units was $391,356

Average Cost of Labor + Average Cost of Product as a percentage of Net sales = 61%

Number of Units

Growth of +17.1% over last 3 years

24,394 units open as of 2021

Source: Entrepreneur.com

The Wolf’s Take 🍟

Given the popularity of the brand, I honestly expected higher revenues per unit out of KFC. Considering it costs a minimum of $1M to open a location, it’s unfortunate that KFC chose not to include EBITDA from franchisee or company owned locations.

Generally speaking, 12-15% margins are healthy for a restaurant, so you would think KFC franchisees fall into that range at a minimum. Regardless, anyone trying to purchase a KFC would have hundreds of franchisees to speak to who would be able to report their exact profitability - so the lack of data in the FDD isn’t an issue for serious buyers.

The UPS Store

Background

Founded in 1980

Headquartered in San Diego, California

Fees, Expenses

Royalty: 5% of Gross Sales

Marketing Fee: 1% of Gross Sales

National Advertising Fee: 2.5% of Gross Sales

Franchise Fee: $29,950

Initial Investment

Traditional Outlets: $137,849 - $566,585

Financial Performance

2019 Average Gross Sales: 521,316

2019 Top 10% Average Gross Sales: $916,057

2019 Bottom 10% Average Gross Sales: $252,427

Note: These statistics are based off of 4,561 reporting locations

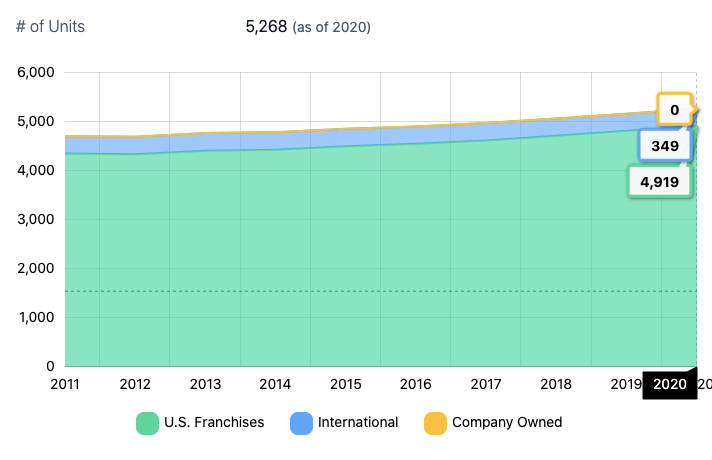

Number of Units

Growth of +5.8% over the last 3 years

5,268 units open as of 2021

Source: Entreprenur.com

The Wolf’s Take 🍟

For franchises, The UPS Store has a very palatable initial investment, as well as royalties and marketing fees being charged. 8.5% in total fees is outstanding given the popularity of the brand. A good rule of thumb for franchises for fees is “6, 3, & 3”:

6% royalty

3% national brand fund

3% miscellaneous fees

With that said, the revenue isn’t super high with an average of about $520k, and just like KFC, The UPS Store doesn’t share any EBITDA data. However, they too have tons of franchisees operating who would provide would-be buyers with their profitability (anytime a candidate is considering buying a franchise, the franchisor provides contact info to all existing franchisees).

That’s it for this week’s Franchise Breakdowns. Feel free to reply with any questions or feedback, or leave a comment. If someone sent this your way and you haven’t subscribed yet, you can also do that below. Thanks and see you next week!

NOTICE REGARDING FRANCHISE INFORMATION

The Wolf of Franchises does NOT guarantee the financial performance of any licensed affiliate or franchise. The decision to purchase a licensed affiliate or franchise must be based on the buyer's independent research. The Wolf of Franchises is not liable for any representation made by an affiliate, associate, marketing material, or Franchise Disclosure Document of a franchise with respect to real estate, financial, operations, or marketing performance of the business being acquired.

This information is not intended as an offer to sell, or the solicitation of an offer to buy, a franchise. It is for informational purposes only, and any financial data and/or projections is clearly based upon information provided by franchises in their respective Franchise Disclosure Document. The offer of a franchise can only be made through the delivery of a franchise disclosure document, from a certified seller of the brand, which The Wolf of Franchises makes no claim to be. Do not consider any information here as a guarantee of financial performance. The Wolf of Franchises has no affiliation or relationship of any kind with any of the brands covered in this newsletter, but simply provides data that is publicly available online or in Franchise Disclosure Documents.

All data from Franchise Disclosure Document’s is based on past performance, and if you were to purchase a franchise covered in the Wolf of Franchises newsletter, it is entirely possible that you lose your entire investment.

The cleaning franchises in 2022 the good the bad the ugly . is buying a brand good